Image Credit: Photo by Anoop VS & Asia91

Vijay, originally from Hyderabad and living in the USA for the past eight years, has been resisting his mother’s constant urging to buy a house in India. She always reminded him how important it was to have a permanent home back in India.

After years of saying no, Vijay finally gave in and bought a modern apartment in Hyderabad. His decision was not only influenced by his mother’s wishes but also by the uncertainty surrounding his future in the US due to the long wait for a Green Card.

Rohan, on the other hand, bought a home for his parents in Mumbai. Even though he has no plans to return to India, he wanted to make sure his parents live comfortably, surrounded by all the luxuries in a modern apartment.

His parents often visit the US to spend time with him and their grandson, but they love being in Mumbai, where they’ve spent most of their lives. Though Rohan sometimes feels guilty about not having them live with him, he finds comfort knowing they have everything they need, including excellent medical facilities.

So what’s the common thread in Vijay’s and Rohan’s stories? It’s the same reason why so many articles, like The Economic Times NRI Desk or ICICI Bank’s Property Guide for NRIs, all focus on one big goal for NRIs: buying a home back in India.

Even top developers like Rustomjee, known for building high-end properties in Mumbai and other metro cities, have released special guides for NRIs. Their Ultimate Guide for NRIs Buying Property in India in 2024 is packed with tips on what types of properties NRIs can buy, an overview of FEMA rules, tax implications, and a step-by-step process to make property buying easier.

All these efforts have a clear purpose: to attract NRIs to invest in India’s real estate market.

Before we dive into why NRIs are buying properties in India in record numbers, let’s take a closer look at the current trends driving NRI real estate investments.

The real estate market for NRIs has experienced remarkable growth, with investments in 2023 alone surpassing $13 billion.

By 2025, NRI investments are expected to make up 20% of all real estate transactions in India. This surge is being driven by several factors, including favorable currency exchange rates, increased transparency through regulations like the Real Estate Regulatory Authority (RERA), and the adoption of digital platforms that make remote property purchases more convenient.

Cities: While traditional investment hubs like Mumbai and Bengaluru continue to capture the most attention, there is a noticeable shift towards Tier 2 and Tier 3 cities.

According to HomesKart and Zoltan Properties, emerging cities such as Pune, Ahmedabad, and Kochi are becoming popular among NRIs for their affordability and strong growth potential.

Investment Patterns: NRIs tend to focus on high-value properties, with a significant portion of their investments targeting residential properties worth over ₹1 crore, particularly in premium and luxury segments.

Real Estate Sector Size: India’s real estate market is projected to reach $1.04 trillion by 2029, up from $227 billion in 2024, driven by a combination of domestic and NRI investments.

Market Growth: The residential real estate sector alone is expected to grow at a compound annual growth rate (CAGR) of 24.77% from 2024 to 2029.

For NRIs, India’s real estate market offers both a deep emotional connection and a solid financial opportunity, bolstered by supportive policies and advances in technology.

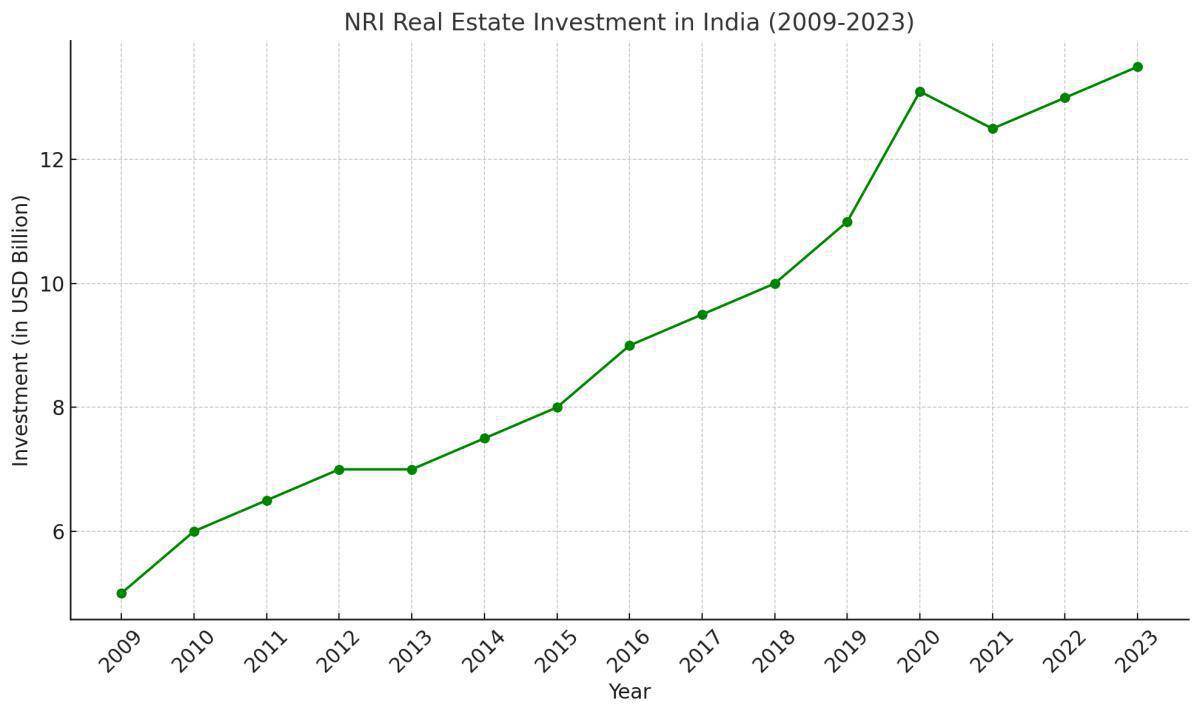

The chart above illustrates the NRI real estate investments in India from 2009 to 2023. The data shows steady growth over the years, with key spikes around 2019-2021 driven by several factors, including currency fluctuations, regulatory reforms, and the COVID-19 pandemic.

Data for NRI Real Estate Investments (2009-2023)

If we were to look at the data for the past 10-15 years, the trend would likely show fluctuations driven by key factors like currency movements, global economic conditions, and policy reforms in India.

Here's an estimated trend over the last 10-15 years:

- 2009-2013: Investments were moderate (~$5-7 billion), influenced by global financial recovery post the 2008 crisis and cautious NRI sentiment due to policy uncertainties in India.

- 2014-2015: A gradual rise (~$8 billion) as India's economic reforms started taking shape, including relaxed norms for foreign direct investment (FDI) in real estate.

- 2016-2017: A slight dip (~$7-9 billion) as the market adjusted to the new RERA regulations and demonetization in India, which temporarily affected liquidity in the real estate market.

- 2018-2019: A steady increase (~$10 billion), driven by regulatory clarity, favorable currency conditions, and the growing preference for luxury real estate among NRIs.

- 2020-2021: The pandemic-related spike (~$13 billion), as explained earlier, caused by a mix of currency advantages, emotional investments, and the digitalization of the buying process.

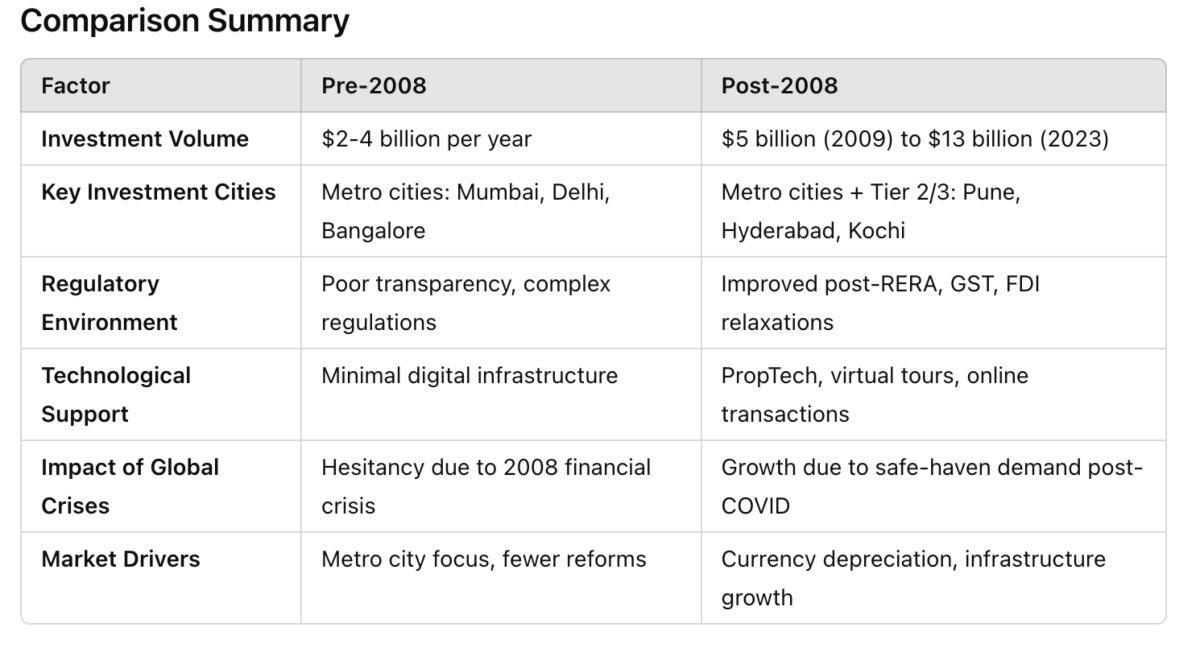

NRI Real Estate Investment Pre-2008 vs. Post-2008:

The pre-2008 period was characterized by a cautious approach from NRIs, with smaller volumes of investment, limited to metro cities and faced with regulatory complexities.

Post-2008, the market matured significantly with regulatory reforms, increased transparency, and wider geographic options.

This allowed NRIs to expand their investments across a broader spectrum, leading to the substantial growth seen over the last decade.

Reference Links for Data:

-

HomesKart

-

Zoltan Properties

-

Various insights are derived from general trends observed in NRI investments, currency advantages, and the impact of government reforms like FDI norms. These sources provide a mix of market data.

In recent years, Non-Resident Indians (NRIs) have increased their real estate investments in India significantly. This trend is driven by a mix of economic, technological, and emotional factors.

Let’s explore some of the key reasons behind this surge in NRI property purchases and the broader implications for the Indian real estate market.