The Indian diaspora in the U.S. is among the most active communities globally when it comes to remittances. The flow of money from the USA to India has been a significant economic force driven by various factors. This article delves into the reasons behind this trend, supported by relevant data, charts, and personal statements.

According to the World Bank, in 2023, the Indian diaspora in the U.S. sent approximately $89 billion out of a total of $125 billion to India, making India the largest recipient of remittances globally.

Media companies have widely reported on this staggering figure, highlighting the economic impact of the Desi-Indian diaspora. But do you know why they are sending this money? This article explores the diverse reasons behind these substantial remittances.

7 Key Reasons for Remittances: Why Indians in the U.S. Are Sending Billions to India-

1. Family Support and Social Obligations

Many in the Indian diaspora have close family ties in India, including parents, siblings, and extended relatives who may depend on financial support. Cultural values emphasize the importance of taking care of one's family, which includes providing monetary assistance for daily living expenses, healthcare, and education.

Anu, a software engineer in California, shares,

"I send $500 every month to my elderly parents in India to cover their living expenses and medical bills. It's my way of ensuring they are comfortable and well taken care of."

2. Investment in Real Estate and Businesses

Members of the Indian diaspora often invest in real estate and businesses in India. With property prices and the entrepreneurial ecosystem growing, many see this as a lucrative opportunity. Investing in their homeland provides a sense of connection and future security.

Sanjay, an entrepreneur in New York, explains,

"I send $1,000 monthly to pay off the mortgage on my apartment in Mumbai. Investing in property back home not only gives me financial security but also a place to return to."

3. Savings and Retirement Planning

The cost of living in India is generally lower than in the USA, making it an attractive option for savings and retirement planning. Many members of the Indian diaspora send money back home to save or invest in pension plans, insurance, and other financial instruments that offer better returns or benefits in India.

4. Charity and Philanthropy

The Indian diaspora is also known for its philanthropic efforts, which have contributed significantly to charitable organizations, social causes, and disaster relief efforts in India. This form of giving back to society is rooted in cultural and moral values.

Meena, a doctor in Texas, says,

"I donate $200 monthly to a non-profit organization in India that provides education to underprivileged children. Supporting these children’s education is my way of giving back to the community."

5. Immigration Uncertainty, Green Card Backlogs, and Job Security

The long wait times and uncertainties surrounding green card applications motivate many in the Indian diaspora to maintain financial stability in India. This includes paying off homes, saving for education fees, and securing investments, ensuring a stable life if they need to return to India due to layoffs or visa issues.

Fear of job loss, especially while on H1B or L1 visas, adds to this need for financial security in their home country.

Raj, a tech professional in Seattle, mentions,

"With the green card backlog and potential layoffs, I make sure to have a paid-off house and savings in India. It's a safety net in case I have to move back."

6. Gifts and Special Occasions

It is common to send money to cousins, close friends, and family for special occasions like birthdays, anniversaries, weddings, and festivals. This helps maintain strong family bonds despite the distance.

Priya, a marketing manager in Chicago, adds,

"I often send money to my cousins and close friends in India for their birthdays and other special occasions. It keeps our connection strong and shows them I care."

7. Paying Off Student Loans

Many Indian students come to the U.S. for higher education, often taking out loans to fund their studies. After graduation, they send money back to India to pay off these education loans.

Ravi, a recent graduate working in San Francisco, says,

"I took a loan for my master's degree in the U.S. Now, I send a significant portion of my salary back home to pay off the loan. It’s important for me to clear this debt as soon as possible."

Data and Figures

According to the World Bank, India received approximately $125 billion in remittances in 2023, making it the largest recipient of remittances globally. A significant portion of this comes from the Indian diaspora in the U.S. Here are some key data points and trends:

-

Remittance Volume Growth: The remittance volume from the USA to India has been steadily increasing over the past decade. In 2023, remittances from the USA constituted about 25% of the total remittances to India.

-

Purpose of Remittances: According to a survey by the Reserve Bank of India (RBI), around 60% of remittances are used for family maintenance, 20% for investment purposes, and the remaining for savings and philanthropy.

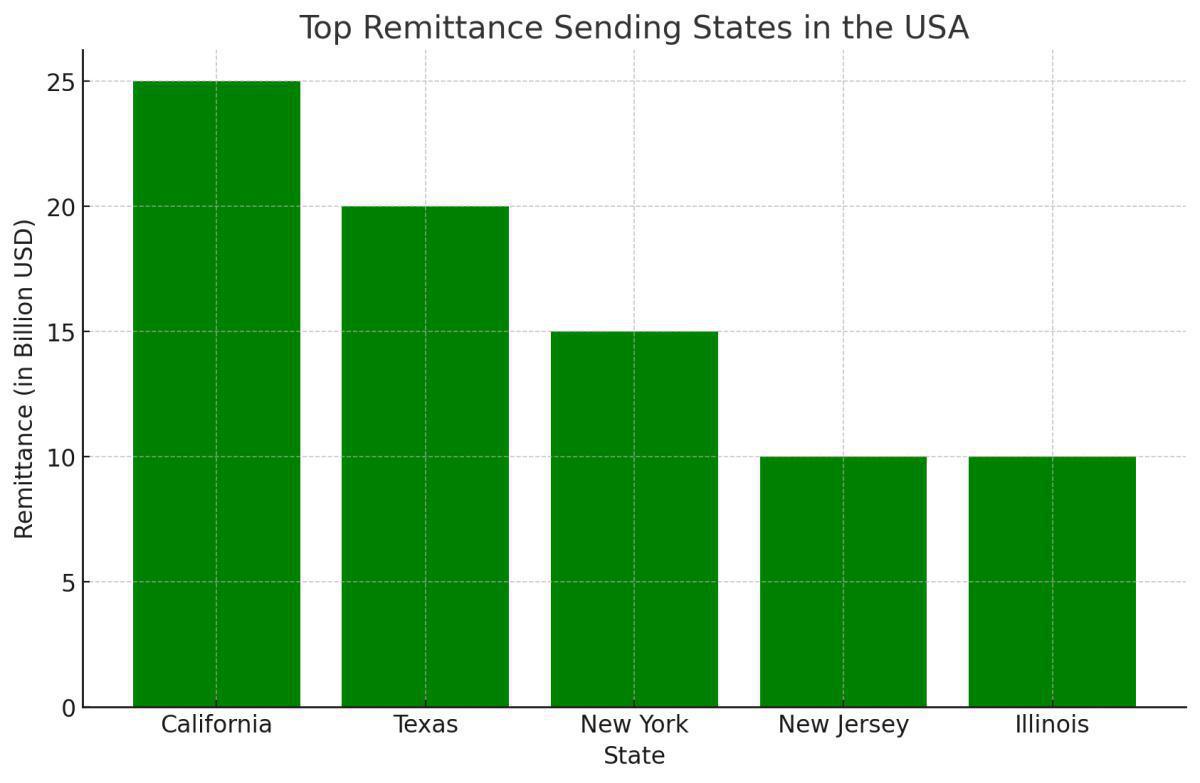

Visual Data Representation

Below are some charts and graphs to illustrate these trends:

Annual Remittance Flow from the USA to India (2010-2023)

Breakdown of Remittance Usage

Top Remittance Sending States in the USA

The flow of money from the Indian diaspora in the U.S. to India is driven by a blend of cultural, economic, and personal factors. Whether it’s supporting family, investing in property, planning for retirement, or contributing to charitable causes, these remittances play a crucial role in the lives of both the senders and recipients. Understanding these trends is essential for grasping the broader economic and social dynamics at play. Jai Ho India!!