According to my friend Rajesh Reddy, who lives in Dallaspuram, there’s a unique list of items he would never consider buying from Indian or South Asian grocery stores—unless absolutely necessary. At the top of this list? Milk.

For NRIs in the USA or Desi South Asians, the routine is clear: milk and eggs are always sourced from trusted American retailers like Walmart, Costco, Kroger, Target, and Tom Thumb.

There’s an unspoken hesitation when it comes to purchasing milk from Indian stores, as if it’s somehow less reliable. Curiously, in the past decade, I can hardly recall seeing anyone push a cart filled with milk in an Indian grocery store

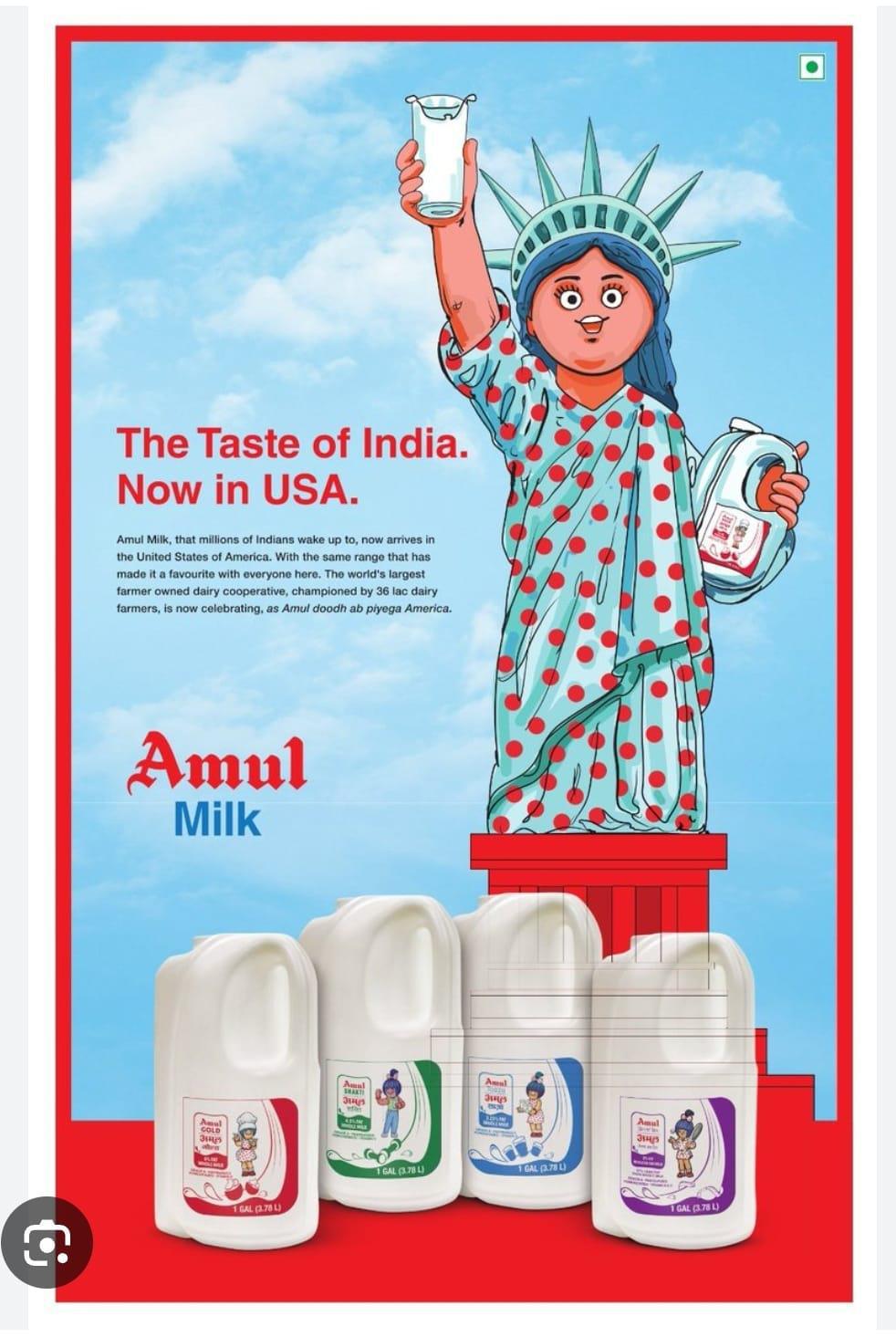

Amul, the iconic Indian dairy brand, is shifting gears in the U.S. after struggling to connect with Indian-Americans through ethnic grocery stores. To expand its reach and address quality concerns, Amul has partnered with Costco, aiming to win over both the Indian-American community and mainstream consumers with its trusted legacy.

A Legacy in Every Drop: The Story of Amul

Amul is far more than just a dairy brand—it’s a symbol of India’s cooperative spirit that began in 1946 in Anand, Gujarat. A group of determined farmers, aiming to free themselves from the grip of middlemen, came together to form a cooperative.

This movement gave birth to Amul, revolutionizing the dairy industry and transforming the livelihoods of countless families. Today, Amul is synonymous with quality dairy products like butter, milk, ice cream, and cheese, deeply ingrained in the daily lives of millions of Indians.

Now, Amul is embarking on a bold new chapter, aiming to share its legacy with international markets. The U.S., with its vibrant Indian-American population and diverse consumer base, is a key target for the brand’s global aspirations.

Image Credit: Amul Dairy | Read More at https://www.amuldairy.com/history.php

Amul's Ambitious Entry into the U.S. Market

Amul officially announced its entry into the U.S. market on March 20, 2024, during a meeting with the Michigan Milk Producers Association (MMPA).

The partnership with the 108-year-old MMPA marked Amul’s first foray into selling fresh milk outside India. Initially, Amul aimed to cater to the Indian diaspora and the wider Asian population by offering its fresh milk products, including Amul Taaza, Amul Gold, Amul Shakti, and Amul Slim n Trim.

Recognizing the growing demand for authentic Indian products among the South Asian diaspora, Amul entered the U.S. market with the goal of offering Indian-Americans a taste of home.

The brand introduced its range of dairy products through ethnic Indian and South Asian grocery stores, a natural starting point given the existing brand recognition among this community.

The plan was simple: deliver quality dairy products that Indian households have trusted for decades. However, early on, Amul faced challenges in terms of distribution and brand perception in the U.S.

Initially, this approach allowed Amul to reach its core audience—those familiar with the brand and eager to purchase products that reminded them of home. However, this niche strategy proved limiting, preventing the brand from making inroads into the broader American market.

Source: Amul.com | Read More at https://amul.com/files/pdf/Press_Release_-_Amul_launches_Fresh_Milk_in_the_United_States_of_America_-_March_2024_26032024.pdf

Early Struggles: Distribution and Quality Perception

Despite the loyalty of Indian and South Asian consumers, Amul encountered several challenges in its early U.S. efforts. Its decision to limit distribution to smaller ethnic grocery stores restricted its visibility and made it difficult to appeal to a larger audience.

Despite having a solid strategy that targeted Indian and South Asian consumers through ethnic grocery stores, Amul quickly encountered hurdles.

While these grocery stores were familiar to Indian-Americans, they weren’t necessarily known for carrying the highest quality of perishables like milk.

This posed a problem for Amul’s products, which rely on freshness and quality to appeal to loyal customers. Many Indian-Americans, accustomed to high-quality dairy products, were reluctant to buy milk from smaller stores that didn’t always maintain strict standards for dairy freshness.

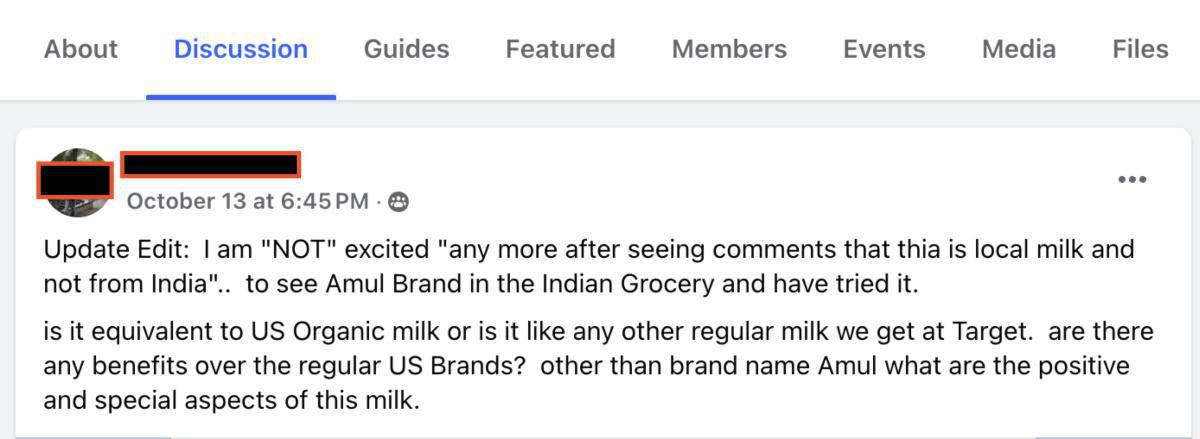

Moreover, the fact that Amul's milk sold in the U.S. was sourced locally from Midwest dairies, like those in Wisconsin, rather than being imported from India, was a surprise to many customers.

Some felt that the brand was capitalizing on its name without offering something uniquely Indian, with one reviewer saying, “It’s just regular local milk with an Amul label slapped on it.” This discrepancy between expectations and reality led to slower growth than anticipated and prompted the brand to rethink its U.S. strategy.

Additionally, some Indian-Americans expressed disappointment that Amul’s milk sold in the U.S. was not imported from India but sourced locally from Midwest dairies such as those in Wisconsin.

While this might have been a smart logistical and cost-saving decision, it stirred a debate among consumers. Many felt that the Amul brand carried an expectation of authenticity and uniqueness, which was perceived to be compromised by sourcing locally.

A Strategic Shift: From Ethnic Stores to Costco

Realizing the need to rethink its strategy, Amul made a calculated and bold move by shifting its focus to Costco, a membership-based retail giant known for its emphasis on quality, value, and trust.

Costco is not only popular among Indian-Americans but also among mainstream American consumers. The retailer’s reputation for providing high-quality products at reasonable prices made it an ideal partner for Amul, which needed a platform to showcase its products to a much broader audience.

By partnering with Costco, Amul ensured its products, especially fresh milk, could reach a larger, more diverse customer base. Costco’s vast distribution network allowed Amul to penetrate households across the country, from Indian-Americans seeking familiar products to curious American consumers drawn to the Amul name.

The choice of Costco was strategic beyond just distribution. The retailer has long been trusted by American consumers for its rigorous quality standards and competitive pricing.

Amul’s alignment with Costco’s brand reinforced its commitment to delivering high-quality dairy products, bridging the gap between its Indian legacy and its U.S. ambitions.

Mixed Reactions: How Consumers Are Responding to Amul

Amul’s decision to shift its distribution to Costco has sparked lively conversations among Indian-Americans, and the feedback has been varied.

On one hand, many consumers are thrilled to see Amul products more widely available and appreciate the convenience of purchasing familiar items at a trusted retailer. A loyal customer shared,

"It’s amazing to see Amul at Costco. The milk is great for making dahi and it brings back memories of home."

However, not everyone is convinced. Some Indian-Americans expressed concerns that the milk Amul sells in the U.S. isn’t imported from India, leading to mixed opinions on the brand’s authenticity.

"It’s just local milk with an Amul label slapped on it," complained another user on social media, reflecting a common sentiment among those who expected the milk to be more than just rebranded local dairy.

Pricing has been another contentious point. Amul’s milk sold through Costco is more expensive than many local U.S. brands.

“I’m paying extra for the Amul name, but the milk doesn’t taste that different from what I can get at other stores for less.” For some, the premium price is justified by the Amul brand’s nostalgia and trust factor, while for others it feels like an unnecessary markup. - Another user on social media

The debate has extended beyond milk to other Amul products like ghee. Some consumers have raised concerns about the quality of Amul’s U.S. ghee, claiming it doesn’t meet the same standards as in India. A longtime Amul fan, commented,

“The ghee feels diluted—it’s not the same as what we get back home.”

A screenshot of a Socia Media Forum where a user posted this.

Can Amul Appeal to Mainstream American Consumers?

Beyond serving the South Asian diaspora, Amul’s partnership with Costco signals a broader ambition: to position itself as a global brand that appeals to mainstream American consumers.

While Amul has a rich heritage that resonates with Indian-Americans, the brand also recognizes the importance of winning over American households if it is to thrive in the competitive U.S. dairy market.

To do so, Amul is leveraging its reputation for quality and trust while introducing products that suit a wider audience’s tastes. By selling through Costco, Amul can showcase its products to American consumers who may be unfamiliar with the brand but are drawn to Costco’s reputation for offering high-quality goods.

This presents Amul with an opportunity to go beyond its niche appeal and truly become a global brand.

The A2 Milk Debate and Health Trends

Amul’s fresh milk launch also comes at a time when U.S. consumers are increasingly focused on health-conscious dairy choices, including A2 milk, which is said to have specific health benefits.

However, some consumers have pointed out that Amul’s milk lacks certain components like DHA (docosahexaenoic acid), which are found in some of Costco’s other milk offerings.

This has led to discussions on whether Amul’s products can truly compete with local brands that emphasize health benefits—an important factor for today’s American consumers.

Quality Concerns: Can Amul Meet High U.S. Expectations?

In addition to the debate over milk, Amul’s other products, like ghee, have also faced quality scrutiny in the U.S. Some customers feel that the ghee sold here is inferior to what’s available in India, with accusations of it being diluted or containing too much vegetable oil.

A disappointed customer, mentioned,

“I used to trust Amul, but the ghee here isn’t as pure as it should be. It doesn’t feel like the real thing.”

These concerns pose a challenge for Amul as it tries to maintain the high standards that consumers expect from the brand while operating in a new and highly competitive market. Maintaining trust will be essential if Amul hopes to expand its U.S. presence.

Costco’s Trust Factor: Reaching Mainstream American Consumers

Costco’s strong reputation for quality plays a crucial role in helping Amul bridge the gap between its traditional customer base and mainstream American consumers.

For years, Costco has built a brand that consumers trust, making it the perfect vehicle for Amul’s products. By placing Amul’s fresh milk and other dairy products in Costco stores, Amul has effectively expanded its reach to American households that may not have encountered the brand before.

For Amul, this partnership signals an ambition to go beyond catering to the Indian diaspora and become a truly global brand. As Costco continues to grow in popularity across the U.S., Amul’s presence in its stores provides the brand with a golden opportunity to appeal to mainstream American families looking for quality products.

This shift represents a significant step in Amul’s transformation into a global player in the dairy industry.

Nostalgia: A Powerful Draw for Indian-Americans

One of Amul’s biggest strengths in the U.S. market is the deep sense of nostalgia it evokes among Indian-Americans. For many, the brand represents more than just milk or butter; it’s a connection to home, family, and cherished memories.

Products like Amul butter and milk are staples in Indian households, used in everyday dishes that bring comfort and familiarity. As one reviewer noted, "Amul milk reminds me of home, and it’s perfect for my homemade yogurt."

This emotional connection has played a significant role in keeping Amul relevant in the U.S. market despite its early challenges.

For many Indian-Americans, the ability to buy Amul products in the U.S. offers not just a taste of home but a way to stay connected to their roots. This nostalgia factor gives Amul a strong foothold among its core audience even as it seeks to expand into new demographics.

The Future of Amul in the U.S.: Balancing Heritage and Growth

Amul’s journey in the U.S. market is one of opportunity and challenge. Its partnership with Costco gives it a strong platform to reach a larger audience, but the brand must continue to adapt if it wants to win over both Indian-American and mainstream American consumers.

Amul’s ability to navigate price concerns, maintain product quality, and stay competitive with local and specialty dairy brands will be crucial to its success.

The U.S. represents a land of opportunity for Amul. By leveraging its rich Indian heritage, aligning with trusted partners like Costco, and making thoughtful adjustments to its product offerings and strategy, Amul has the potential to become not just a household name in Indian-American homes but also a recognized and trusted brand in mainstream America.

If Amul can continue building trust and deliver consistent quality, the future looks bright for this iconic Indian dairy brand in the global market.